Is a home office tax deductible? The answer ‘yes,’ but there are strict guidelines to make sure you’re compliant with your country’s tax laws. A backyard workspace, shed, or garden office should qualify as a home office if you use it as a dedicated workspace, but not under certain conditions.

And, just because you are a remote worker, even during the COVID-19 lockdown, you may not qualify for the home office tax deduction if you don’t live in a country which allows it. Find out what you need to know about the home office tax deduction in the US, UK, and Canada, how much money you can deduct, and how to claim it.

Is a Home Office Tax Deductible in the US?

In the US, a home office is tax deductible for business owners or independent contractors who ‘exclusively and regularly’ use part of their home, or a structure on the property, as a primary place of business. Mortgage interest, rent, insurance, repairs, utilities, expenses, maintenance, and depreciation may qualify as expenses.

According to the IRS, you may be eligible for the home office tax deduction if you meet the following criteria:

- You are a business owner or independent contractor with a 1099, not an employee

- Your home office is used to conduct business on a regular basis and is exclusive to the business

- Administrative or management activities are conducted at the home and there is no other location to perform these duties

- Your rent or own your home

- You live in a house, apartments, condominium, mobile home, boat, or similar property

- Work primarily from a structure on your property, like an unattached garage, studio, barn, or greenhouse

Side Gigs and W-2 Jobs

In the US, the home office tax deduction does not apply to employees who receive W-2’s. It only applies to you if you are a business owner or independent contractor with a 1099.

Unfortunately, if you use a home office for your side gig or W-2 job, you can’t claim the home office deduction, unless you are an independent contractor. However, you may qualify for the ‘administrative use exception.’

Administrative Use Exception

You may qualify for the administrative use exception if you conduct administrative or management activities from home and can’t do them at the office. This includes things like billing clients or patients, accounting, ordering supplies, setting appointments, and writing reports. A good example is a Physician who sees patients all day at the office and does not have time while the office is open to complete these additional responsibilities.

This exemption is tricky, though, and you should talk to a CPA to see if you qualify.

Backyard Workspace or Detached Structure

If you use your shed, barn, studio, or garden office as a home office you may qualify for the tax deduction. The IRS requires that it is a workspace where you work ‘exclusively and regularly’ and that it is not used for other things. If you store farm equipment or gardening supplies in it, it doesn’t qualify.

How Much Money Can You Claim For A Home Office?

The amount of money you can claim for a home office depends on the option chosen. Choosing the Regular Method will provide a larger deduction if the home’s square footage is sizable and the home office is large. The Simple Option deduction has a $1500 and 300 square foot maximum.

In the US, you can tack on more deductions for qualifying business expenses, such as:

- Mortgage interest

- Rent

- Property taxes

- Homeowners insurance

- HOA expense

- Utilities

- Depreciation

To calculate your deduction using the regular option, just divide the square feet of your home by the square footage of your home office to get a percentage. Then add up the qualifying monthly expenses The deduction with this method will be larger when you have a large home and a dedicated home office with lots of square footage. Many calculations are much higher than $1500.

How to Claim a Home Office on Your Taxes

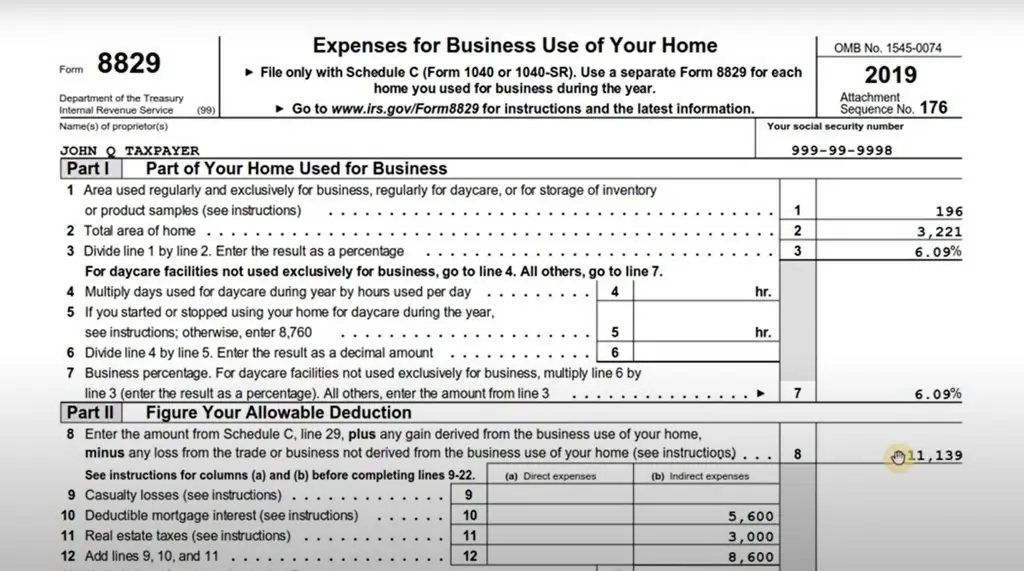

US taxpayers have 2 options to calculate home office expenses and need to use Form 8829 to claim them.

Simplified Option

The simplified option allows $5 per square foot with a maximum size of 300 square feet. This makes the max deduction $1500. Typically this deduction is less than the regular option for many people.

Regular Method

For the regular method, deductions are based on the percentage of the home used for business use and direct expenses are deducted in full. This may be a good option for you if you have a home office workspace larger than 300 square feet, store inventory in a dedicated space in your home, or work out of your garage.

Is A Home Office Tax Deductible in Canada?

A home office is tax deductible if the workspace is the principal place of business, is used solely to earn income for the business, and is used on a regular and ongoing basis to meet clients, customers, or patients.

A home office is tax deductible if the workspace in your home meets 1 of the following conditions:

- The workspace is your principal place of business

- You use the workspace only to earn business income and it’s used on a regular and ongoing basis to meet clients, customers, or patients

How Much Money Can You Claim For A Home Office?

There are 2 options for Canadians: the Temporary Flat Rate Method and the Detailed Method.

The Temporary Flat Rate Method has a maximum amount of $400 per individual in 2020 and $500 per individual in 2021 and 2022.

The Detailed Method allows you to claim the actual amounts you have paid, which usually results in a bigger deduction. You should keep receipts and supporting documents in case you need to prove it.

How to Claim a Home Office on Your Taxes

In Canada, you can claim the home office tax deduction by calculating the deductible portion.

To do this, divide the total area of the home office by the total area of your home. If you use part of your home for business and personal living, determine the hours in a day you use the workspace for business and divide by 24 hours. Multiply this result by the business part of your total home expenses to give you the total household cost you can deduct.

Temporary Flat Rate Method

During COVID-19, many employees were forced to work from home and the Canadian government has offered a tax break for them. If you worked more than 50% of the time from home for at least 4 consecutive weeks due to COVID-19, you can claim $2 per day. This is only available for 2020-2022.

Detailed Method

The detailed method is for employees who work from home due to COVID-19 plus eligible employees who work from home all the time. With this method, you can claim the actual amount you paid.

Is A Home Office Tax Deductible in the UK?

In the UK, a home office is tax deductible for employees working remotely as long as the employer does not have an office or the employee is required to live far from it.

The HMRC allows a home office tax deduction for employees working remotely, in certain circumstances.

You may be eligible for the deduction if you meet certain criteria:

- You work from home all or part of the week because your job requires you to live far from the office or your employer does not have an office

You are not eligible to claim a home office tax deduction if:

- You are choosing to work from home even though your employer has an office space

- You work from home because of COVID-19

- You can’t go to the office because it’s full and your employer doesn’t have a workspace for you

How Much Money Can You Claim

The amount of tax relief you get depends on your basic tax rate.

You can claim tax relief on £6 a week from April 6, 2020 without keeping evidence of business expenses. The option is to claim the exact amount of extra costs that are more than £6 a week. Keep receipts, bills, or contracts to prove the exact amounts.

For example, if you pay the 20% basic tax rate and claim £6 a week, then you’d get 20% of £6, which is £1.20 a week.

How to Claim a Home Office on Your Taxes

The HRMC offers 2 ways to calculate the home office deduction:

Simplified Business Expenses

The simplified business expenses method is fairly easy to calculate, but the deduction is usually small and doesn’t include expenses. You need to determine how many hours you spend working each week and deduct a flat rate from your taxes. Business expenses, like internet and phone bills, need to be calculated separately.

Actual Costs Method

The actual costs method takes more effort but usually ends up being a bigger deduction. Calculate the actual costs of running your home office, including expenses, and deduct the business portion.

The actual costs method is usually a bigger deduction and worth the extra time it takes to calculate, but not for everyone. Consult an accountant to get a personalized look at your tax situation to make sure you’re getting the full benefit.

Final Thoughts

A home office tax deduction is a great way for small business owners and remote workers to get tax relief. In the US, UK, and Canada, your backyard workspace, garden office, or studio most likely qualifies as a home office as long as you don’t store equipment in it or use it for other things. In the UK and Canada, remote worker employees may be able to claim the deduction as well as business expenses. Please consult a tax advisor before filing taxes to get the full story on your personal tax situation.